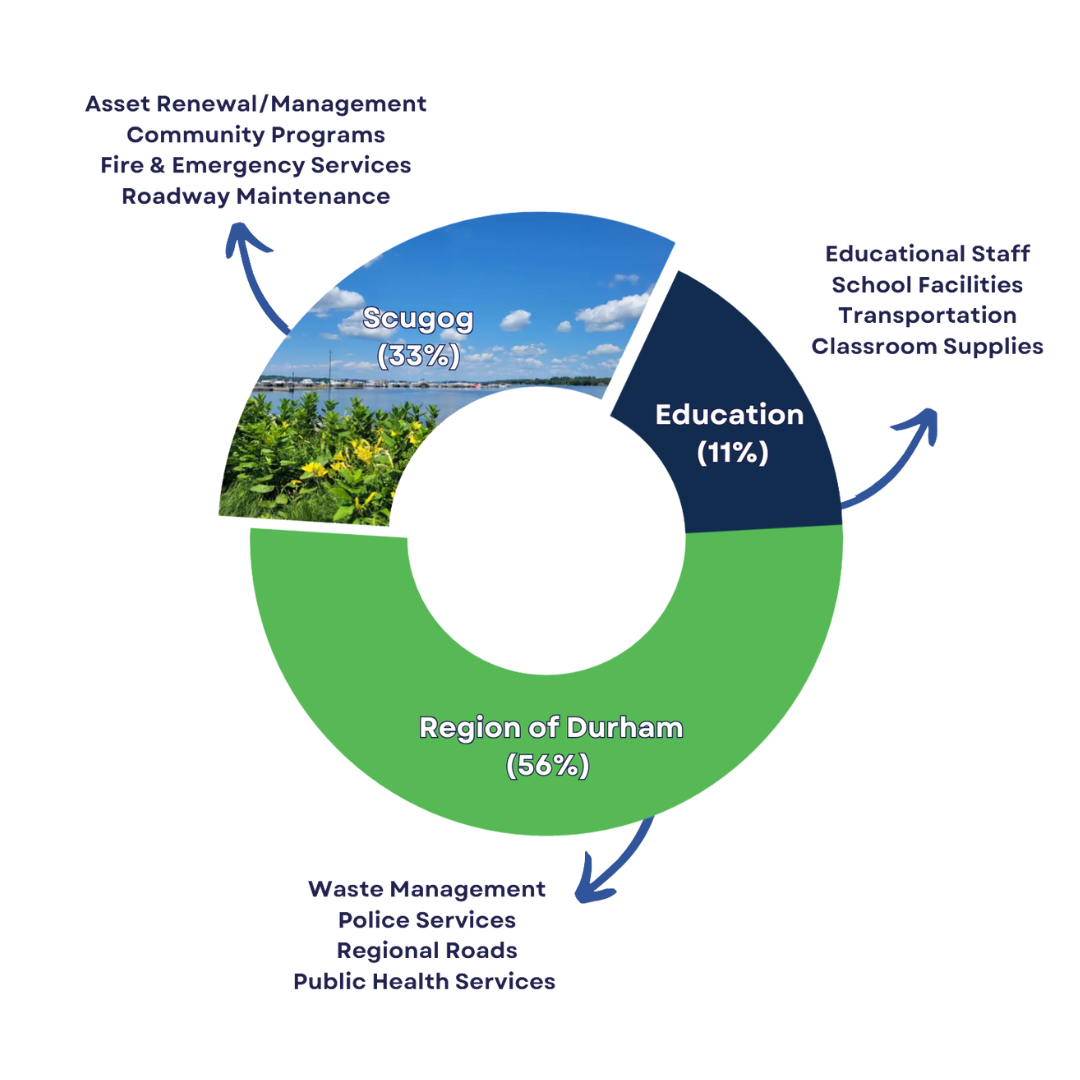

Where do your Property Tax Dollars Go?

Each year, the Township undergoes a robust process to create an annual budget that delivers the services and programs residents and businesses rely on.

Did you know, out of all the property taxes you pay, the Township of Scugog only keeps 33% to operate its services and maintain the infrastructure that you use everyday?

Budgets can be complex, but they have a significant impact on the services we can offer. Your tax dollars are used to manage services in the community we live in to serve you better. Check out the list of services we provide for families and youth in Scugog!

Capital Budget

The Capital budget outlines Scugog's plan for long-term projects. Examples of capital expenses may include:

- Infrastructure development, building and construction projects (e.g. building new roads, bridges and sidewalks)

- Park and greenspace improvements

- Fleet expansion and maintenance (e.g. purchasing new fire trucks and snow plows)

Operating Budget

The Operating budget outlines our spending plan for the upcoming year. This includes the day-to-day costs of running:

- Fire and Emergency services

- Township Facilities (e.g. Scugog Arena, Blackstock Recreation Complex, Birdseye Aquatic Facility, Scugog Public Library, Scugog Shores Museum and Town Hall)

- Recreation programs

- Road maintenance

- By-law enforcement

- Debt payments and transfers to reserves

Online & Paper Opportunities

Community members can also share their 2026 Township budget priorities:

- By calling the Municipal office to request a paper budget feedback form at 905-985-7346

Feedback received will be shared with members of Council and municipal staff during the 2026 municipal budget process. All individual responses will be anonymous and will only be used to summarize overall feedback received from the public.

Surveys

Submit a Question

Budget 2026 - Submit a Question

To ask a question you must create an account or log in.

These are the people that are listening and responding to your questions.

The Project Team

{{question.description}}